Account Manager Daniel Rowson shared insights based on Barcelona’s recent housing intervention, where the city acquired 'Casa Orsola' to prevent tenant evictions, as reported in Bloomberg. This approach raises questions about what similar approaches could mean for London’s property industry.

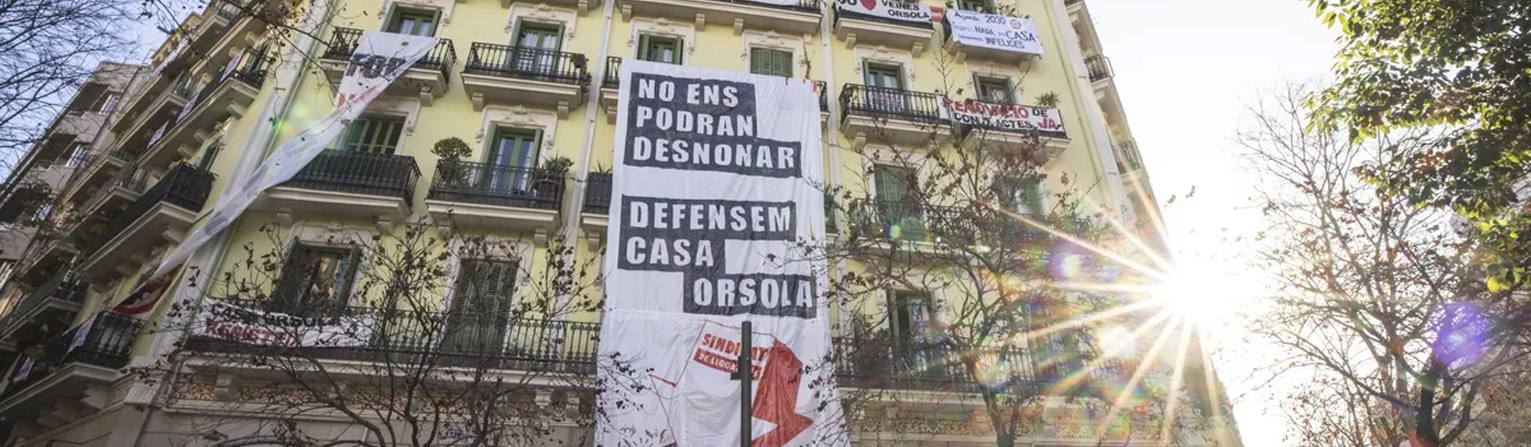

In a divisive response to mounting eviction protests, Barcelona's city hall has acquired the iconic 'Casa Orsola' apartment building following months of protests against renovating the building which would see present tenants evicted. This intervention marked the end of a political storm for city hall, which speaks to the core of Barcelona’s housing issues.

Barcelona's Intervention

'Casa Orsola,' an Art Nouveau apartment block, became a focal point of renters’ outcry when its tenants faced eviction threats. The building's owner, Lioness Investments, had plans to convert the apartments into medium-term rentals, generating fears of gentrification and the loss of affordable housing. In response to months of sustained protests and community activism, Barcelona's city hall intervened, purchasing the property for approximately €9 million—which city hall argues is 30% below market value. This acquisition ensures that all apartments will be converted into social and affordable housing, providing long-term security for the current residents.

Mayor Jaume Collboni emphasised the city's dedication to combating over-tourism and real estate speculation, stating that such measures are essential to maintain the social fabric of Barcelona's neighbourhoods. This move aligns with broader efforts to address Spain's housing crisis, where cities are increasingly taking proactive steps to protect vulnerable tenants.

Not Without Controversy

Despite the government’s justification for the purchase, critics argue that the acquisition sets a dangerous precedent , potentially deterring private investment in Barcelona’s housing market. The purchase has been labelled a form of "moral hazard," where landlords may now expect city hall to intervene in disputes, potentially incentivising speculative pricing and risky investment behaviour. Additionally, concerns have been raised over the use of public funds for such acquisitions when alternative policy solutions—such as strengthening tenant protections or regulating medium-term rentals—could offer broader, more sustainable solutions. Some critics also argue that the intervention effectively rewards property speculators by allowing them to offload assets at a profit, instead of addressing systemic issues in the rental market.

London's Housing Dilemma

Here in London we face our own housing challenges. The city's housing crisis is marked by a severe shortage of affordable homes, escalating rents, and a significant number of households in temporary accommodations. In an attempt to address these issues, some London boroughs have initiated programmes reminiscent of Barcelona's approach.

For instance, Newham Council has launched a £20 million Preventative Eviction Acquisition Programme. This initiative aims to purchase properties where tenants are at risk of eviction due to landlords exiting the rental market. By acquiring these homes, the council seeks to provide tenants with secure, long-term housing and reduce the strain on its homelessness services. The programme is expected to facilitate the purchase of up to 44 properties, each costing around £450,000, including refurbishment expenses.

However, London's approach to expanding social housing has faced some challenges. In certain instances, efforts to repurpose properties have led to changes for existing tenants. A notable example is Lambeth Council's buy-back scheme, which affected at least 150 families residing in privately rented homes on estates earmarked for redevelopment. While these initiatives aim to increase the availability of social housing, they also highlight the complexities of balancing redevelopment with tenant stability.

Challenges and Considerations

While the concept of municipal intervention in the housing market offers a promising avenue to protect tenants, its implementation in London presents unique challenges:

- Funding Constraints: The financial outlay required to purchase properties in London's expensive real estate market is substantial. Councils often operate under tight budgets, limiting the scale and impact of such programmes.

- Unintended Displacement: Efforts to convert privately rented properties into social housing can inadvertently lead to the eviction of current tenants, as seen in Lambeth. This raises ethical and practical concerns about the execution of such policies.

- Policy Limitations: National policies, such as the 'Right to Buy' scheme, have historically reduced the stock of available social housing. Although recent measures have been introduced to curb the rapid sell-off of council homes, the long-term effects of these policies continue to pose challenges to increasing the availability of affordable housing.

- Private Sector Confidence: If the GLA were to buy properties that the private sector is seeking to develop, this may discourage investment and reduce the overall supply of rental properties and the regeneration of housing stock, creating instability.

In conclusion, while Barcelona's recent actions provide an example of how cities can intervene to protect tenants, London's path requires careful navigation of financial, social, and policy-related challenges. Moreover, the concerns surrounding Barcelona’s intervention—particularly regarding market confidence and the precedent it sets—suggest that a direct replication of this model in London may not be the best approach. Instead, a balanced strategy that includes tenant protections, sustainable social housing investment, and clear market regulations may offer a more viable long-term solution to the city’s housing crisis.